Museum seeks artifacts for video, Town’s ‘40th’

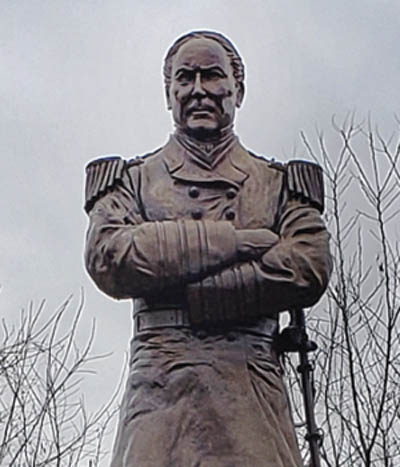

Statue of Adm. David Glasgow Farragut in Farragut Memorial Plaza, Municipal Center Drive.

Statue of Adm. David Glasgow Farragut in Farragut Memorial Plaza, Municipal Center Drive.

Physical items are also sought for the exhibit.

Items from the 1970s to after Farragut’s incorporation on Jan. 16, 1980, are needed. Photos of roads, neighborhoods, businesses, schools and other local entities would be especially helpful.

If anyone has artifacts that might be of interest, e-mail photos of the items to Historic Resources coordinator Julia Barham at jbarham@townoffarragut.org.

The Museum will not accept items left at Town Hall without prior approval and completion of required paperwork. The Museum is seeking donations, loans and digital rights to photos.

Determination on whether the item is appropriate for donation or loan is at the discretion of the Farragut Museum staff and based on what currently part of the collection.